Mutual Funds: A Comprehensive Overview

Mutual Funds: A Comprehensive Overview

For many, the world of investments can seem daunting, with Mutual Funds often appearing as a complex financial product. However, understanding the basics of Mutual Funds can open the door to a more informed and confident investment journey. Let’s break down what Mutual Funds are and how they work, making it easier for you to navigate this investment avenue.

What Are Mutual Funds?

At its core, a Mutual Fund is a financial vehicle that pools money from multiple investors to invest in a diversified portfolio of securities. This pooled fund is managed by professional fund managers who make investment decisions on behalf of the investors. By doing so, they aim to achieve the common investment objectives set by the fund.

Related Posts :

Free EBook Mutual Funds

/ म्यूचुअल फंड्स से संपत्ति बनाने का सपना अब आपके हाथ में! > क्या आप अपने पैसे को सही जगह निवेश कर करोड़पति बनने का

Top 45 Most Searched Topics About SIP in India (SIP full form) : A Comprehensive Guide for Beginners and Investors

SIP ka Full Form: “Systematic Investment Plan” hai. Introduction to Systematic Investment Plans (SIP) Systematic Investment Plans (SIPs) have become a popular method for wealth

How to Calculate Your Retirement Needs?

Introduction In this article, I will explain how to calculate your retirement needs and why it is essential for your financial security. Retirement planning is

Step-by-Step Guide: Building a Retirement Corpus with Mutual Funds

Introduction In this article, I will explain what a Systematic Investment Plan (SIP) is and how it can benefit your retirement corpus. SIP is a

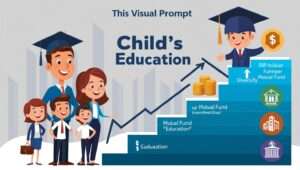

Planning for Higher Education: Leveraging Mutual Funds for Your Child’s Success

Introduction In this article, I will explain how you can leverage mutual funds to secure your child’s higher education. Education costs are rising every year,

What is a Riskometer: A Quick Guide

Introduction In this article, I will explain what is a Riskometer and how it plays a crucial role in helping investors understand the level of