Understanding Debt Funds: A Secure Path to Steady Returns

Understanding Debt Funds: A Secure Path to Steady Returns

Investing in the financial market can often feel like navigating uncharted waters, especially with the volatility associated with equity investments. For those who prioritize safety and steady returns, Debt Funds offer a viable alternative. In this post, we’ll explore what Debt Funds are, their benefits, and why they might be an excellent choice for conservative investors.

What Are Debt Funds?

Debt Funds are a type of Mutual Fund that primarily invests in fixed-income securities. These include Corporate and Government Bonds, corporate debt securities, and money market instruments. Often referred to as Fixed Income Funds or Bond Funds, these funds aim to provide investors with regular income and capital preservation by investing in relatively safer instruments.

Related Posts :

Free EBook Mutual Funds

/ म्यूचुअल फंड्स से संपत्ति बनाने का सपना अब आपके हाथ में! > क्या आप अपने पैसे को सही जगह निवेश कर करोड़पति बनने का

Top 45 Most Searched Topics About SIP in India (SIP full form) : A Comprehensive Guide for Beginners and Investors

SIP ka Full Form: “Systematic Investment Plan” hai. Introduction to Systematic Investment Plans (SIP) Systematic Investment Plans (SIPs) have become a popular method for wealth

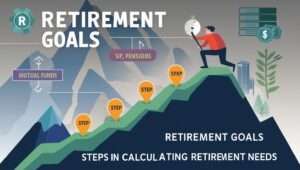

How to Calculate Your Retirement Needs?

Introduction In this article, I will explain how to calculate your retirement needs and why it is essential for your financial security. Retirement planning is

Step-by-Step Guide: Building a Retirement Corpus with Mutual Funds

Introduction In this article, I will explain what a Systematic Investment Plan (SIP) is and how it can benefit your retirement corpus. SIP is a

Planning for Higher Education: Leveraging Mutual Funds for Your Child’s Success

Introduction In this article, I will explain how you can leverage mutual funds to secure your child’s higher education. Education costs are rising every year,

What is a Riskometer: A Quick Guide

Introduction In this article, I will explain what is a Riskometer and how it plays a crucial role in helping investors understand the level of